Handling a construction business can be complex, from project management to customer relations. The administrative and financial side of it also has its challenges involving the payroll, material costs, equipment expenses and more.

Finding the right bank can make the difference between proper financial management and misusing funds.

Best Banks for Maine Construction Businesses

The best banks for construction businesses in Maine should have tailored services that can open doors to financing and grow the company in the long run. Here are some suggestions:

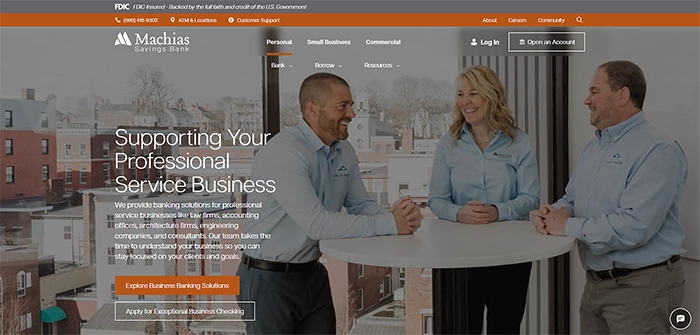

1. Machias Savings Bank

Machias Savings Bank is committed to moving its local community and businesses forward, making it the best bank for Maine construction businesses. It is very transparent in its financial status and builds up a culture of trust and positive reinforcement.

Machias Savings Bank has plenty of experience working with professional service businesses, whether it’s with architecture firms, engineering companies and more. It offers numerous business banking solutions like Exceptional Business Checking, which comes with with zero monthly fees and no minimum balance needed

Key features:

- Offers MSB Online to view all banking information in one place

- Ensures safe online banking with advanced encryption measures

- Has responsive customer support

2. Maine Community Bank

Maine Community Bank invests its resources into building a thriving and empowered community within the state. It has almost $3 billion in assets and a full range of personalized products and services to support families, businesses and neighborhoods.

Construction businesses, even startups, are well-supported through commercial and small business loans. Connect with dedicated teams who will help them set up and find success in their banking journey.

Key features:

- Offers personalized attention and solutions for business growth

- Provides online and mobile banking for effective cash flow management

- Gives local merchant services to curb cash flow disruption and streamline payments

3. Atlantic Federal Credit Union

Atlantic Federal Credit Union is a nonprofit institution that consists of local Mainers who want to help their fellow community members find financial success. Profits are re-invest into its organization and offerings to ensure top-notch service.

Commercial Construction Loans are provided to help fuel construction projects, but there are also dedicated business loans like lines of credit or small business administration loans. The equipment loan special can be beneficial when financing new equipment. It even features reduced rates and lender fee savings.

Key features:

- Offers business insurance like workers’ compensation and more

- Provides a Business Money Market account to give better rates for bigger balances

- Has virtual banking hours for quality customer service

4. Midcoast Federal Credit Union

Midcoast Federal Credit Union is a full-service not-for-profit cooperative that provides financial services and education throughout Maine. Its team consists of financial industry professionals that serve its members’ financial needs.

Midcoast Federal Credit Union has partnered with Business Lending Solutions, LLC to provide a variety of loan solutions. Many are curated to support both large and small financing goals to empower businesses of all sizes.

Key features:

- Offers services like digital banking and email notifications

- Provides High Deductible Health Care Plans for businesses

- Ensures personalized and flexible repayment options for loans

5. Bangor Savings Bank

Bangor Savings Bank is a mutually-held community bank that helps individuals and businesses attain financial wellness and economic mobility. Its modern and innovative banking products are meant to promote excellence and sustainability.

When it comes to business financing, Bangor Savings Bank offers a wide variety of loans with competitive rates. There are construction loans meant for interim and long-term financing for renovations, repairs and other similar options.

Key features:

- Offers payroll solutions to support companies

- Provides 24/7 online banking

- Protects businesses with Bangor Insurance

6. Bar Harbor Bank & Trust

Bar Harbor Bank & Trust is committed to helping its community reach its financial goals through its technology-powered offerings and personalized service. It can be especially helpful for small businesses seeking banking solutions.

Checking and savings accounts are provided for better cash flow management. Construction businesses can also take advantage of their equipment financing program, with rates as low as 5.75% APR with zero down payment.

Key features:

- Provides online and mobile banking for convenience

- Offers fast loan approval and closing

- Helps with payroll services

7. Camden National Bank

Camden National Bank helps make a difference within its community through its banking solutions. It can help property developers, investors and construction businesses of different natures access cost-effective lending solutions.

Its team ensures that financial plans are customized for reaching each companies’ long-term goals. It even assists small businesses in getting stable growth, whether it’s through checking and savings accounts, business lending and more.

Key features:

- Provides digital banking services

- Offers 24/7 customer service

- Listens to its customers through Camden Circle to simplify the banking experience

8. Northeast Bank

Northeast Bank is a full-service bank that originates and purchases commercial loans nationally. There are also several other business banking services like accounts, financing options and cash management.

There are services specifically made for construction businesses, such as the Commercial Truck Finance program. It helps them fund light duty, heavy duty and specialized commercial vehicles. Competitive rates and terms are available.

Key features:

- Offers business credit cards with competitive introductory rates

- Provides effective and secure cash management tools

- Enables Business High-Yield Savings

9. North One Bank

North One is a financial technology company that has partnered with The Bancorp Bank, NA to provide business banking accounts for company owners and entrepreneurs. These are designed to earn one of the highest APYs and cashback rewards.

A dashboard with connected tools is available to manage every inch of a company’s finances all at once. There are also lines of credit and loans available that all have a quick application and decision process.

Key features:

- Offers automated bill pay features

- Sends paper checks by mail

- Has commercial construction management guides on its blog

10. Rockland Savings Bank

Rockland Savings Bank is a small community bank that serves all your banking needs while providing exceptional customer service. Businesses can easily get a checking account and get imaged monthly statements of their cashflow.

Businesses can also get a savings account with zero monthly maintenance fees or minimum balance. Business construction loans are also available with competitive closing costs, alongside real estate and term loans.

Key features:

- Offers payroll services

- Provides online and mobile banking services

- Ensures 24-Hour Telephone Access

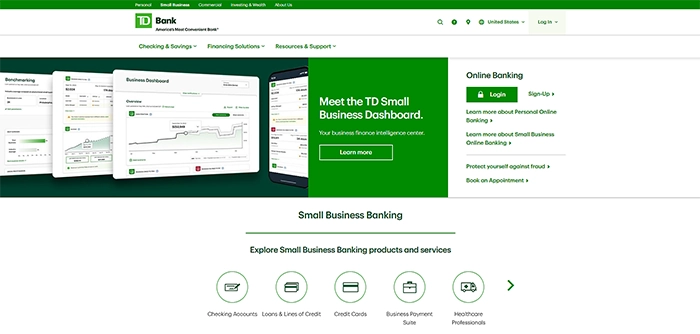

11. TD Bank

TD Bank has served numerous small business and commercial customers, known as one of the 10 largest banks in the United States. It integrates diversity, inclusion and sustainability throughout its business practices.

It offers many small business banking products such as checking accounts, credit cards and more. It ensures to offer financial solutions that will suit no matter what stage of the business journey the company is in.

Key features:

- Offers online banking features

- Delivers flexible financing options geared for business growth

- Guides companies in selling its business when needed

12. Androscoggin Bank

The Androscoggin Bank values its local relationships and aims to empower each individual and business to thrive. It offers a variety of banking features to businesses of all sizes, like a checking and savings account.

The Androscoggin Bank also provides cost-effective banking solutions that are tailored to each business. Construction and manufacturing businesses can look forward to specialized cash management strategies, equipment loans and project financing.

Key features:

- Offer online and mobile banking features

- Sends check deposits right to a company’s business address

- Prioritizes sustainable banking solutions

Methodology for Assessing Banks for Construction Businesses

It’s critical to be discerning of where to put company funds. Here are the factors used to narrow down the best banks for Maine construction businesses:

| Transparency in details | Are the terms and conditions for each account or offering provided clearly? Are there any hidden fees to be wary of when using their services? |

| Financial fees | Are there competitive interest rates available? Will the banks request any monthly maintenance fees, or are they waived upon application? |

| Services | Does the bank provide the services that aligns with the construction company’s needs the most? Are their programs made specifically for those in the construction industry? |

| Convenience | Do they offer digital banking options to their clients? Are there ATMs and physical locations within the vicinity? Are there any additional cash flow management tools that simplify the banking experience? |

| Customer service | Are there customer service representatives that will provide assistance if any issues occur? What is their customer base saying about their services? |

| Financial stability and security | Is the bank in a good financial position and will remain open for the foreseeable future? What security measures is it taking to protect accounts? |

How to Choose the Right Bank

Choosing the right bank for a construction company is another obstacle to surpass. Here’s an overview of how to make the best decision:

1. Understand Business Needs

Similar to how all banks have their own set of offerings, a construction business likely has its own set of needs. Try to evaluate what the business currently needs to understand its compatibility to the best banks in Maine.

For instance, a company wants to take its business to the next level and fund a big project. It’s important to look for business loans that would meet the large-scale financing needed for it. Online banking is ideal when prioritizing convenience.

2. Compare the Pros and Cons

Try to see the pros and cons of working with each bank. Seeing what aligns the most with priorities and non-negotiables will bring a construction company one step closer to banking with the right institution for them.

Compare the services and programs to one another as well. For instance, loan offers can all have different conditions in terms of repayment schemes, interest rates and more. Try to understand what works best for a company’s financial situation and capabilities.

3. Review the Account Requirements

Review the business account requirements under each bank. There are general similarities, such as personal and business identification, business formation documents, operating agreements and the like.

Some may have other specific requirements that may make them unqualified, like a large initial deposit. If that’s the case, look for banks with more flexible terms or those that work with small businesses.

4. Integrate Into the Business Process

After narrowing down the options, it’s time to figure out how using those banks work with the current business’s operations. For instance, using the payroll services to simplify distributing employee wages will require process adjustments and training.

It’s important to understand the timeline with each of the services to see whether it fits the company’s own schedule in financial terms and management. For example, if loan approvals take too long, adjustments must be made or it’s time to evaluate other options.

Benefits of Using a Bank

There are numerous benefits to working with a bank as a construction business. Here are a few benefits behind integrating it into the planning process:

1. Managing Cash Flow

Many banks provide a clear view of a company’s cash flow, which can improve how they navigate using their funds. If they need to verify that funds went to a certain transaction, the account history can help them out. Better cash flow management can also empower them to make more accurate financial forecasts, which is imperative when making decisions for the future.

2. Simplify Cash Management

Most banks already offer virtual banking options and a range of other technology-powered features that can help companies manage their business funds in a variety of ways. Whether it’s paying penalties or bulk buying materials for upcoming projects, these institutions let all these transactions go through online.

3. Accessing Business Loans

Business loans can help a construction company move around, as they can fund materials for projects or secure equipment needed for operations. There are also specific ones like equipment loans, which help fund purchasing or leasing machinery without having to exhaust current financial resources.

4. Growing the Business

Banking professionals understand what a business needs to grow, and they can serve as a financial advisor that will suggest different strategies to help them reach that. For instance, some may recommend opening up a savings or money market account that would help their capital scale up in the long run.

Improve Construction Business’ Financial Management

Financial institutions are the pillars of the local community, especially when it comes to economic sustainability and growth. Check out the best banks for Maine construction businesses and take control of finances.